- Five Forces Analysis Apple Inc. Price

- Five Forces Analysis Apple Inc. User

- Apple Inc. Five Forces Analysis (porter's Model)

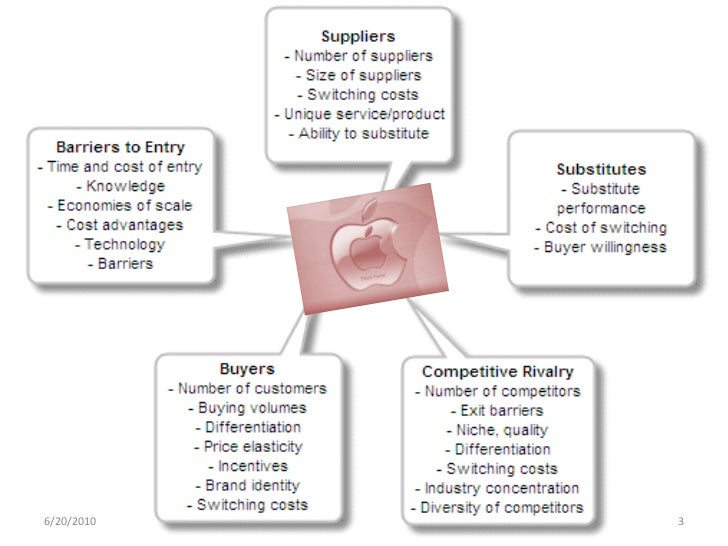

Apple Inc. has gained massive success through Macintosh operating system and computers as well as iPhone, iPad, and other products despite the up and down cycles it has gone through since 1976, the year it was founded (Beagle, 2011). In 2014, the company achieved a key distinction by becoming the 1st company in the U.S. to ever reach a market capitalization exceeding $ 700 billion (Mohammd & Alam, 2015). Its success largely depends upon its creative ability to invent and create unique products in the market continually. This dependence has considerably engendered brand loyalty. Apple's marketing strategies and product development depict its awareness of the need to deal with the main marketplace forces that can make an impact on its profitability and market share.

Apple in the Marketplace from a Five Forces Perspective

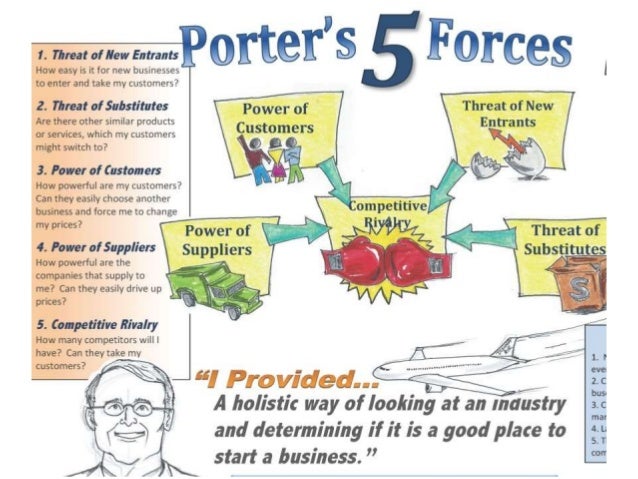

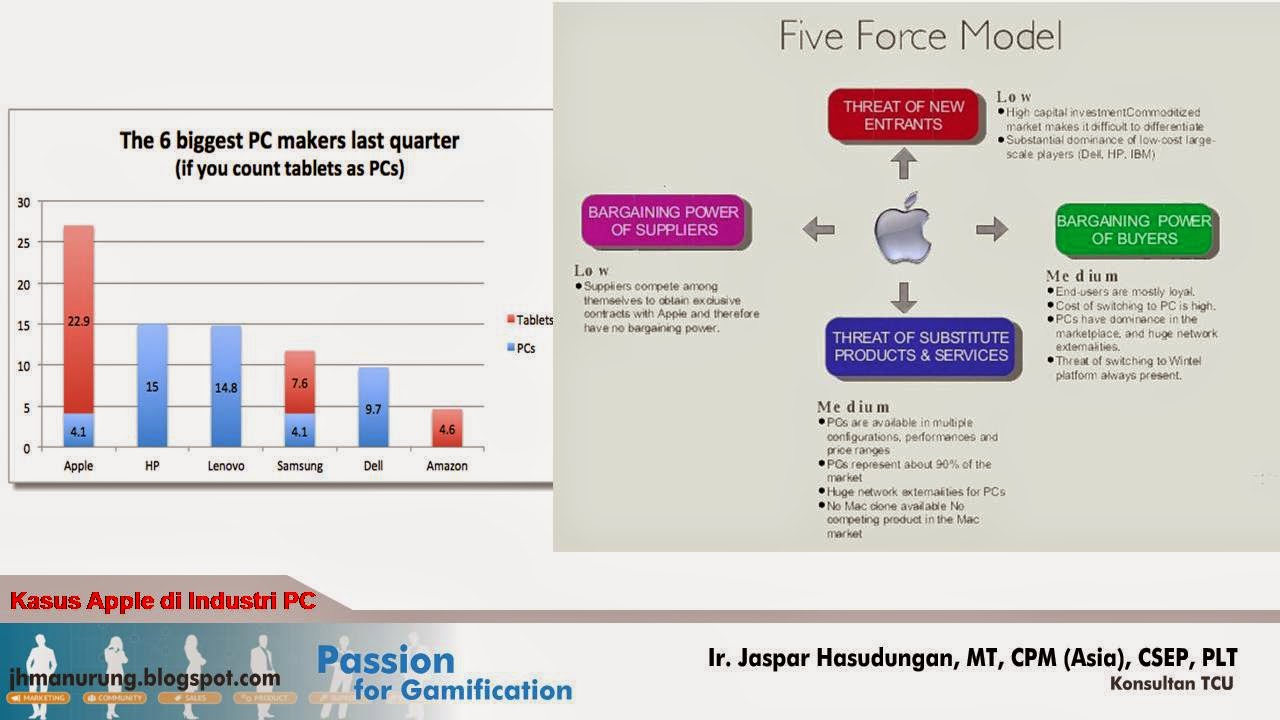

A Five Forces analysis of Apple Inc. Sheds light on what the company does to ensure industry leadership despite the negative effects of external factors in the competitive landscape of the computer software and hardware, consumer electronics, and online digital content distribution markets, which involve firms like Microsoft, Google, Amazon, Walmart, Samsung, Dell, Sony, and Lenovo. Established in 1976, Apple has succeeded to become a dominant competitor in the industry under the leadership. In order to succeed against. NASDAQ: AAPL Porter's Five Forces. Porter's 5 Forces is one of the most recognized frameworks, used to assess the competitiveness and attractiveness of a particular company and its industry.

Industry Competition

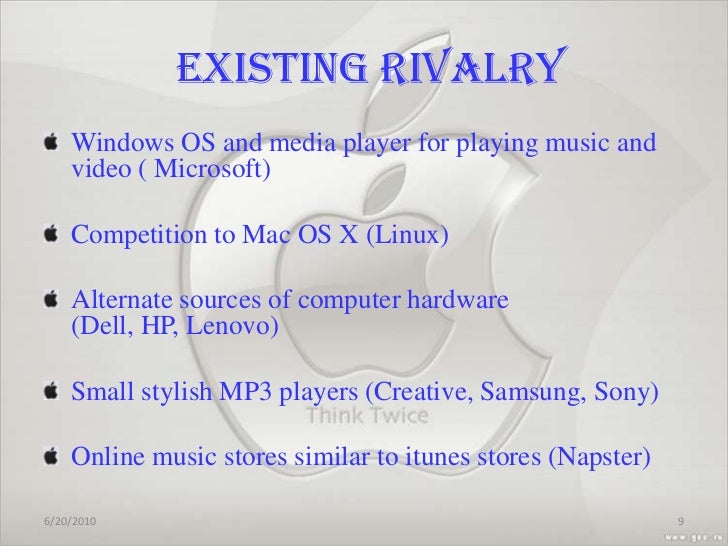

The level of rivalry among the major companies that are in direct competition with Apple in the technology industry is rather high. Apple directly competes with such companies as Samsung Electronics Co., Google, Inc, Amazon, and Hewlett-Packard Company (Beagle, 2011). All of these companies expend huge capital on marketing, research, and development similar to Apple does. Indisputably, the competitive force influencing the industry is strong. One factor that contributes to the high level of competitiveness in the industry is low switching costs (HBR, 2014). It means that it hardly takes a substantial amount of investment for a consumer to abandon Apple's iPhone in favor of Google Pixel phone. The threat of marketplace competition has earned a mammoth consideration from this technology company, and it has responded amicably by concentrating on product differentiation to strengthen and increase the position of market share (Beagle, 2011). For instance, according to the research outfit Canaccord Genuit, approximately more than 1000 companies produce Smartphones in the world, but Apple has still reaped 92% of all profits gained by the top eight makers of Smartphones in the world in the 1st quarter of 2015 (Mohammd & Alam, 2015). Therefore, the external factors influencing Apple are high aggressiveness and low switching costs which are both strong forces.

Bargaining Power of Buyers

The occurrence of low switching cost in the industry gives strength to buyers' bargaining power, thus, becoming a major force for Apple, which is worth considering. Within this force, there are basically two points of analysis, namely: individual bargaining power of buyers and their collective power to bargain (Magretta, 2011). For Apple, losing a single customer corresponds to a negligible amount of revenue (Mohammd & Alam, 2015). Thus, the individual power to bargain is a weak force to this company. However, it is important to note that the customers' collective bargaining power in the marketplace and the possibility of mass exodus to a competitor is a strong force. Apple responds to the influence of this strong force by increasing huge capital expenditures in Research and Development to enable investments in unique products such as the Apple Watch and Apple Pay as well as establishing momentous brand loyalty (Mohammd & Alam, 2015). Apple has enjoyed a long period of success in this segment of competition evidenced by a large customer base who, primarily, would not change their iPhones for a different phone from a competitor. In summary, the buyers' strong power is externally influenced by a small number of individual buyers, which is a weak and low switching force (a strong force).

Threat of New Entrants to the Marketplace

Five Forces Analysis Apple Inc. Price

The threat of a new entrant in the industry that could pose a serious threat to Apple's share in the market is relatively low. This phenomenon results from two principal factors: the high cost of entrance in the industry and additional cost of creating a recognized brand name (Magretta, 2011). A new entrant faces already strong competitive industry with large and well-established firms (Porter, 2008). Another challenge is forming brand name recognition within an industry with very strong brand recognition that already dominated by many companies such as Apple, Amazon, and Google (Magretta, 2011). Although there is a possibility of a new entrant, possibly a Chinese company with enormous government financial support, challenging Apple's top position in the near future, the chances of such a firm arising to the highest level is totally remote. In short, the threat of a new entrant is a moderate force due to huge capital requirement (weak force), the capacity of a new entrant to perform extraordinarily (strong force) and high cost of developing a brand (weak force).

Bargaining Power of Suppliers

This force is relatively weak within the marketplace for Apple's products. Despite having less than two hundred suppliers, Apple has a variety of options because of a large number of suppliers globally (Mohammd & Alam, 2015). The industries of the suppliers of its parts are highly competitive as with the firms manufacturing computer processors. Apple also enjoys relatively low switching cost, if necessary, from one supplier to another. Moreover, it serves as a major customer for its suppliers; hence, any supplier must be very reluctant to lose Apple (Beagle, 2011). This condition weakens the ability of suppliers to impose their demands on the company (HBR, 2014). This part of Porter's five forces analysis indicates that Apple gives almost zero consideration to the bargaining power of suppliers while creating strategies for industry leadership and innovation (Magretta, 2011). Therefore, suppliers have weak bargaining power due to the high overall supply (weak force) and a high number of suppliers (weak force).

How It Works

Pay for it

Download your paper

Threat of Substitutes or Substitution

In the framework of Porter's model, substitute products are not the ones in direct competition with the products of the company but possible replacements. In this case, the landline telephone is a good example of a substitute for iPhone. The influence of this force is relatively low for Apple products because the substitutes have limited capabilities compared to them (Magretta, 2011). For example, iPhone has immense capabilities compared to a landline which can only make calls. Thus, the influence of substitution on Apple's business is weak due to the high availability of substitutes (emerging as a moderate force) and the low performance of substitutes (weak force). This part of the model depicts that Apple hardly prioritizes this kind of threat in the business processes such as product design, development, and marketing.

The five forces analysis of this giant company's position in the technology sector indicates that the buyers' bargaining power and competition in the industry are the strongest marketplace forces that influence Apple's profitability (Porter, 2008). The other three are regarded as weaker elements among the major forces in the industry.

Apple Generic Strategy

Generic strategy employed by this company is broad differentiation over cost leadership. It focuses on specific features that differentiate it and its products from the competitors. Apple's ecosystem is its biggest competitive advantage (Mohammd & Alam, 2015). According to CEO Time Cook, Apple is distinguished from other competitors by its expertise in hardware, software, and services (Beagle, 2011). Apple emphasizes elegant designs, high-end branding, and user-friendliness. This strategy has been effective in differentiating the company. For example, iPhone 7 is the first phone in the world to come without an opening for a headphone jack. Apple operates in an almost closed ecosystem with proprietary stores (Nawaz, Abbas & Rasheed, 2015). Consequently, the company gains more control of its value chain and component costs. It has a popular and tightly integrated ecosystem of all the companies in the world involved in technology products. Apple's software and devices are compatible with one another and can synchronize to enable sharing and copying of media and preferences with many devices.

Apple has defined its target consumers, and, regardless of the environment where it markets its products, the company has never made price-friendly products like its competitors such as Samsung. For example, to capture the African market, Samsung produces phones costing as much as $20. A study conducted by a research firm GfK in 2011 indicates that 84% of people owning iPhone plan to buy another Apple handset when they eventually replace their cell phone (Beagle, 2011). The study also indicated that more than 70% of consumers are constantly attracted by uninterrupted access to unlimited contents and features offered by mobile OS (Beagle, 2011). Since the push for an ecosystem with an enhanced value addition is a greater priority in the technology industry, the tendency of establishing brands to lure customers from competitors has reduced (Jinjin, 2013). As a result, the richest reward is enjoyed by providers with the ability to create brand loyalty and build the most harmonious user experience (Mohammd & Alam, 2015). A recent study conducted by the United States Congress on trade between the U.S. and China revealed that Apple innovation, while engineering and developing iPod and its ability to shift its production to low-cost countries, has enabled it to increase profitability and gain competitive advantage and simultaneous source for high-paying jobs within the border of U.S. (Mohammd & Alam, 2015). Therefore, creativity and innovation has enabled the company to enhance product differentiation that has fueled its dominance in the market.

Apple Inc. SWOT Analysis

The current success of Apple Inc's results from its ability to utilize its strengths in overcoming threats and weaknesses and exploiting available opportunities.

Strengths

Innovation: Apple enjoyed strong visionary leadership of Steve Jobs with a knack for keeping the pace of the fast-moving technology curve. This was evident since the launching of iPhone in 2007 and iPad in 2010 as mobile internet devices. For instance, the recently launched iPhone 7 and iPhone 7 plus come with the latest aspects of iPhone experience not found with any other rival, for example, scratch, splash, and dust resistance.

Rock-Solid Finances: The Company has consistently been a cash cow since the launch of iPhone (Jinjin, 2013). Apple amasses exceptionally high margins of profit compared to the average margins in the industry thereby giving it the advantage to conduct business at multiple levels.

Brand Image: Apple enjoys a strong brand image, and the company has continued to be the most valuable company with the value of $124.4 billion (Mohammd & Alam, 2015).

VIP Services for Premium Quality

10,95 USD

Get order prepared by Top 10 writers

The occurrence of low switching cost in the industry gives strength to buyers' bargaining power, thus, becoming a major force for Apple, which is worth considering. Within this force, there are basically two points of analysis, namely: individual bargaining power of buyers and their collective power to bargain (Magretta, 2011). For Apple, losing a single customer corresponds to a negligible amount of revenue (Mohammd & Alam, 2015). Thus, the individual power to bargain is a weak force to this company. However, it is important to note that the customers' collective bargaining power in the marketplace and the possibility of mass exodus to a competitor is a strong force. Apple responds to the influence of this strong force by increasing huge capital expenditures in Research and Development to enable investments in unique products such as the Apple Watch and Apple Pay as well as establishing momentous brand loyalty (Mohammd & Alam, 2015). Apple has enjoyed a long period of success in this segment of competition evidenced by a large customer base who, primarily, would not change their iPhones for a different phone from a competitor. In summary, the buyers' strong power is externally influenced by a small number of individual buyers, which is a weak and low switching force (a strong force).

Threat of New Entrants to the Marketplace

Five Forces Analysis Apple Inc. Price

The threat of a new entrant in the industry that could pose a serious threat to Apple's share in the market is relatively low. This phenomenon results from two principal factors: the high cost of entrance in the industry and additional cost of creating a recognized brand name (Magretta, 2011). A new entrant faces already strong competitive industry with large and well-established firms (Porter, 2008). Another challenge is forming brand name recognition within an industry with very strong brand recognition that already dominated by many companies such as Apple, Amazon, and Google (Magretta, 2011). Although there is a possibility of a new entrant, possibly a Chinese company with enormous government financial support, challenging Apple's top position in the near future, the chances of such a firm arising to the highest level is totally remote. In short, the threat of a new entrant is a moderate force due to huge capital requirement (weak force), the capacity of a new entrant to perform extraordinarily (strong force) and high cost of developing a brand (weak force).

Bargaining Power of Suppliers

This force is relatively weak within the marketplace for Apple's products. Despite having less than two hundred suppliers, Apple has a variety of options because of a large number of suppliers globally (Mohammd & Alam, 2015). The industries of the suppliers of its parts are highly competitive as with the firms manufacturing computer processors. Apple also enjoys relatively low switching cost, if necessary, from one supplier to another. Moreover, it serves as a major customer for its suppliers; hence, any supplier must be very reluctant to lose Apple (Beagle, 2011). This condition weakens the ability of suppliers to impose their demands on the company (HBR, 2014). This part of Porter's five forces analysis indicates that Apple gives almost zero consideration to the bargaining power of suppliers while creating strategies for industry leadership and innovation (Magretta, 2011). Therefore, suppliers have weak bargaining power due to the high overall supply (weak force) and a high number of suppliers (weak force).

How It Works

Pay for it

Download your paper

Threat of Substitutes or Substitution

In the framework of Porter's model, substitute products are not the ones in direct competition with the products of the company but possible replacements. In this case, the landline telephone is a good example of a substitute for iPhone. The influence of this force is relatively low for Apple products because the substitutes have limited capabilities compared to them (Magretta, 2011). For example, iPhone has immense capabilities compared to a landline which can only make calls. Thus, the influence of substitution on Apple's business is weak due to the high availability of substitutes (emerging as a moderate force) and the low performance of substitutes (weak force). This part of the model depicts that Apple hardly prioritizes this kind of threat in the business processes such as product design, development, and marketing.

The five forces analysis of this giant company's position in the technology sector indicates that the buyers' bargaining power and competition in the industry are the strongest marketplace forces that influence Apple's profitability (Porter, 2008). The other three are regarded as weaker elements among the major forces in the industry.

Apple Generic Strategy

Generic strategy employed by this company is broad differentiation over cost leadership. It focuses on specific features that differentiate it and its products from the competitors. Apple's ecosystem is its biggest competitive advantage (Mohammd & Alam, 2015). According to CEO Time Cook, Apple is distinguished from other competitors by its expertise in hardware, software, and services (Beagle, 2011). Apple emphasizes elegant designs, high-end branding, and user-friendliness. This strategy has been effective in differentiating the company. For example, iPhone 7 is the first phone in the world to come without an opening for a headphone jack. Apple operates in an almost closed ecosystem with proprietary stores (Nawaz, Abbas & Rasheed, 2015). Consequently, the company gains more control of its value chain and component costs. It has a popular and tightly integrated ecosystem of all the companies in the world involved in technology products. Apple's software and devices are compatible with one another and can synchronize to enable sharing and copying of media and preferences with many devices.

Apple has defined its target consumers, and, regardless of the environment where it markets its products, the company has never made price-friendly products like its competitors such as Samsung. For example, to capture the African market, Samsung produces phones costing as much as $20. A study conducted by a research firm GfK in 2011 indicates that 84% of people owning iPhone plan to buy another Apple handset when they eventually replace their cell phone (Beagle, 2011). The study also indicated that more than 70% of consumers are constantly attracted by uninterrupted access to unlimited contents and features offered by mobile OS (Beagle, 2011). Since the push for an ecosystem with an enhanced value addition is a greater priority in the technology industry, the tendency of establishing brands to lure customers from competitors has reduced (Jinjin, 2013). As a result, the richest reward is enjoyed by providers with the ability to create brand loyalty and build the most harmonious user experience (Mohammd & Alam, 2015). A recent study conducted by the United States Congress on trade between the U.S. and China revealed that Apple innovation, while engineering and developing iPod and its ability to shift its production to low-cost countries, has enabled it to increase profitability and gain competitive advantage and simultaneous source for high-paying jobs within the border of U.S. (Mohammd & Alam, 2015). Therefore, creativity and innovation has enabled the company to enhance product differentiation that has fueled its dominance in the market.

Apple Inc. SWOT Analysis

The current success of Apple Inc's results from its ability to utilize its strengths in overcoming threats and weaknesses and exploiting available opportunities.

Strengths

Innovation: Apple enjoyed strong visionary leadership of Steve Jobs with a knack for keeping the pace of the fast-moving technology curve. This was evident since the launching of iPhone in 2007 and iPad in 2010 as mobile internet devices. For instance, the recently launched iPhone 7 and iPhone 7 plus come with the latest aspects of iPhone experience not found with any other rival, for example, scratch, splash, and dust resistance.

Rock-Solid Finances: The Company has consistently been a cash cow since the launch of iPhone (Jinjin, 2013). Apple amasses exceptionally high margins of profit compared to the average margins in the industry thereby giving it the advantage to conduct business at multiple levels.

Brand Image: Apple enjoys a strong brand image, and the company has continued to be the most valuable company with the value of $124.4 billion (Mohammd & Alam, 2015).

VIP Services for Premium Quality

10,95 USD

Get order prepared by Top 10 writers

11,55 USD

Get VIP Support

Five Forces Analysis Apple Inc. User

4,60 USD

Get order Proofread by editor

2,00 USD

Get extended REVISION

3,00 USD

Get SMS NOTIFICATIONS

2,00 USD

Get additional PLAGIARISM CHECK

34,10 USD

23,87 USD

VIP Services

package

Weaknesses

Premium Pricing: The Company's computing devices are classically among the most priced products on the market. However, Apple attempted to expand into the large value segment following the launch of its scaled-down iPhone 5C in 2013. Unlike other similar models, it did not come with a great commercial success. The luxury positioning has hampered its ability to make substantial inroads in countries with considerable pressures on ordinary consumers (Jinjin, 2013). It also exposed the vulnerability of the company to price competition from Samsung.

Opportunities

Market-Share Growth: Even though the company has had a historic growth spurt in the past, it continues to enjoy plenty of room for extending the share of the traditional computing space. Presently, Apple has about -20% piece of the global PC/tablet pie, more than the competitors such as Samsung and Lenovo. However, this number is yet to increase in the coming years even as it gains ground in China and other parts of Asia/ Pacific region (Mohammd & Alam, 2015).

Threats

Apple Inc. Five Forces Analysis (porter's Model)

Competition:Rivalry is the biggest threat to any tech outfit, considering the persistent product cycles and the rapid move towards commoditization in the industry and the fickle nature of consumers today (Nawaz, Abbas & Rasheed, 2015). Cannibalization has been a big concern here even as it expands to mobile Internet devices.

Gross Margin Pressures: These pressures shoot from increased competition and consequential loss of pricing power, product shortages and increasing component prices (Nawaz, Abbas & Rasheed, 2015). An unfavorable mix budges away from the dominant iPhone line and could reduce profit margins as well.

Apple's Grand Strategy into the Future

Given Apple's grand reality, product development is the main intensive growth strategy. This strategy requires offering attractive products to ensure growth in its market performance and share. With a decline in core iPhone business, the company requires new businesses to boost earnings and sales. Lately, Apple has focused its attention on providing booming services built around the large ecosystem of users (Nawaz, Abbas & Rasheed, 2015). In 2014, Apple partnered with IBM in order to keep enterprise customers in mind (Mohammd & Alam, 2015). The step signified the company's actions to diversify its keys strategy of product development.

In conclusion, this article analyzes Apple Inc. based on Michael Porter's five forces in relation to its position in the industry and its external structure including the key operations to develop and sustain a competitive advantage in the market. At present, the company is successful in sales and enjoys the highest customer satisfaction ratio. In addition, Apple works on cost minimization and broadens the board of directors to foster corporate governance.